UAE Central Bank Discusses The Implementation Of The Targeted Economic Support Scheme To Contain Coronavirus

The Board of Directors of the Central Bank of the UAE, CBUAE, held its third meeting this year via video conference under the chairmanship of Hareb Masood Al Darmaki, the Chairman of the Board.

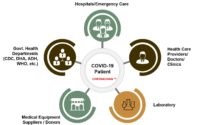

The Chairman opened the meeting discussing the implementation of the Targeted Economic Support Scheme to contain the repercussions of the coronavirus, COVID-19, pandemic, which was approved by the board during its remotely convened meeting held on Friday, 13th March 2020. Following deliberations and discussions, the Board instructed continuous follow-up of implementation of the scheme and taking necessary measures and actions in this regard.

The Board also discussed its agenda which included: Several topics presented by the Banking Operations Department regarding: – Reuse of excess banknotes from the re-printing orders for the years (2017, 2018 and 2019) for the AED 100 and AED 500 denominations.

– Revising fees related to credit and debit cards (IRF & MDR); being one of important tools that is widely used in payment transactions executed on the points of sale of merchants, or on the websites supporting ecommerce.

Following that, the Board then discussed a memo presented by the Higher Sharia Authority regarding the Sharia governance standards for Islamic financial institutions. The Board approved the governance standards developed by the Higher Sharia Authority, pursuant to the provisions of Decretal Federal Law No. (14) of 2018 and the Higher Sharia Authority’s Charter, according to which the Authority undertakes setting of rules, general principles and standards for Islamic businesses and activities, develop a general framework for Sharia governance and issue fatwas and eligibility standards. This standard is considered complementary to the governance of banks.

Moreover, the Board reviewed a memo presented by Financial Stability Department regarding Stress Testing the UAE banking sector.

The Board also reviewed applications submitted by some banks and financial institutions and granted approvals to applications that met their respective requirements, as per the law and established regulations.

The Board also discussed a memo presented by Regulatory Development in Banking Supervision Department regarding “Transfer of Significant Ownership Regulation”. The Board approved the said regulation and instructed publication thereof following audit and review.

The Board also reviewed Central Bank’s Q4 Report for the year 2019 covering international economic developments, domestic economic developments, financial stability indicators, banking liquidity, monetary aggregates and the Central Bank balance sheet. The board instructed publication of the report on the Central Bank’s Website.

In addition, the Board reviewed the external auditor’s report on the Central Bank’s financial statements as at 31 Dec. 2019.

The Board completed the discussion of the remaining topics listed on its agenda, as well as other topics, and took appropriate decisions.

The meeting was attended by Abdulrahman Saleh Al Saleh, Deputy Chairman of the Board; Mubarak Rashed Al Mansoori, the Governor, and Board members including: Younis Haji Al Khoori, Khaled Mohammed Salem Balama, Khalid Ahmad Al Tayer and Ali Mohammed Al Madawi Al Remeithi, and a group of senior CBUAE employees.