UAE-Based Investors Tapping Into The US Equities Market Unlock Exclusive Advantages

In the past years, investors based in the GCC have shown a rising interest in investing in the US Equities market, in addition to their activity on the vibrant GCC Equities markets, especially in the UAE and KSA. This has driven trusted trading companies to cater to such ambitions by providing exclusive advantages that allow them to tap into the full potential of the US Equities market which houses iconic exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ.

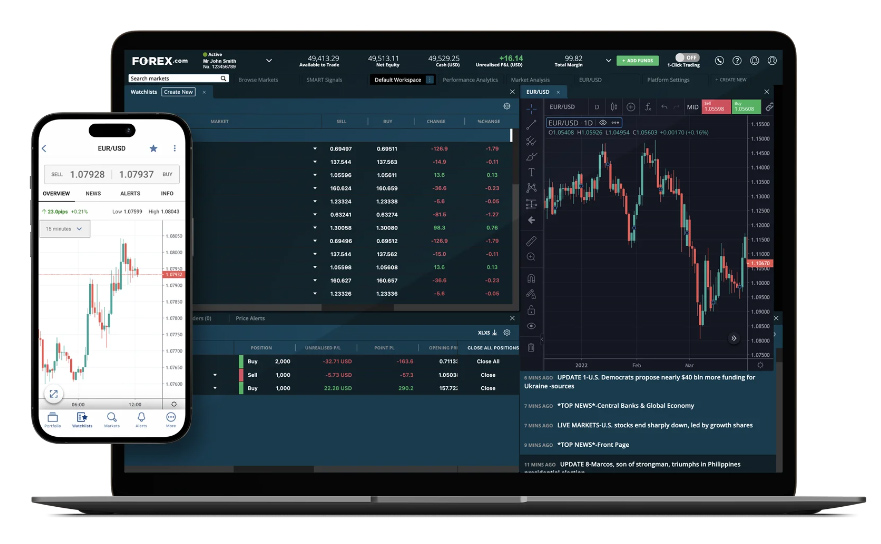

According to FOREX.com Part of StoneX Group, one of the most dynamic trading companies in the UAE, evolving with customers’ requires great agility and fast action. In this line, the company has just announced that its customers can now trade a wide range of leading US stocks, including Tesla, Meta, and Amazon, commission-free*, offering UAE-based investors new possibilities in the world’s largest equities markets.

“Now, FOREX.com customers can trade tier-one US stocks without any commission fees*. They also benefit from competitive pricing and extended trading hours for major US Stocks with privileged access to earnings reports, both before and after regular market hours. This gives them a definite edge rather than waiting for the market to open which could delay their investment opportunities”, says Ritu Singh, Regional Director at FOREX.com.

From a wider perspective, research has revealed that GCC stock markets may exhibit varying degrees of association with the Dow Jones stock market, one of the most prominent indices in the US. Additionally, there is significant evidence of return and volatility spillover between GCC stock markets and global factors.

This level of correlation between the two markets can fluctuate, depending on prevailing circumstances. However, UAE-based investors seem to find the two markets complimentary.

On one hand, the US stock market is home to an expansive range of sectors and industries, offering diversified investment opportunities. On the other hand, GCC markets are more sector-concentrated. Despite the fact that oil and gas hold significant sway in such markets, they’re growing steadily and more diversified with sectors such as technology, real estate, and manufacturing attracting the attention of global funds, contributing to shielding these markets from oil price shocks, as stated in a report published in the Journal of Chinese Economic and Business Studies, dubbed “The financial interconnectedness between global equity markets and crude oil: evidence from the GCC.”

It is noteworthy that FOREX.com allows investors to trade 5,500+ popular stocks, commission-free until March 31, 2024.

Disclaimer: *Bid and Ask spread cost still applies.