The UAE: Is USD864,000 Enough For Your Retirement?

Standard Chartered’s new Wealth Expectancy Report, which examines the saving and investment habits of 10,000 emerging affluent, affluent and high-net-worth individuals (HNWIs) across 10 fast-growing economies, reveals a universal challenge: people’s aspirations outstrip their ‘wealth expectancy’, or their total net wealth at age 60.

Savers in the UAE, with a wealth expectancy of USD864,000, face one of the smallest wealth expectancy gaps amongst the markets surveyed: by the time they are 60, close to six in 10 (56 per cent) of people in the UAE will be more than halfway to achieving their aspirations.

This compares to a global trend where nearly six out of 10 people on average across the markets surveyed are facing a ‘wealth expectancy gap’ of 50 per cent or more.

While savers in the UAE regard financial security as critical to quality of life and happiness, they also to focus on living in the here and now. In the affluent group, for example, 51 per cent of individuals say they prefer to live in the moment rather than worry about their financial future.

The UAE’s wealth expectancy

The average wealth expectancy of those in the UAE with enough disposable income to save and invest is USD864,000, or USD391,000 for the emerging affluent, USD922,000 for the affluent and USD1,278,000 for HNWIs.

On average, this would give people in the UAE USD6,639 to live on per month during retirement, which is less than both their current income and their wealth aspiration. If they were to spend at the average monthly rate to which they aspire, their wealth expectancy would last the emerging affluent 11 years, the affluent 13 years of retirement, while HNWIs would be able to fund 13 years.

Standard Chartered’s Wealth Expectancy Report 2019 shows that savers in the UAE combine simple savings products with property investment to achieve their financial goals. While 62 per cent of the emerging affluent say financial security is critical to quality of life and happiness, many don’t use any investment products saying they prefer to focus on short-term goals rather than having money tied up in investments (53 per cent).

What are people in the UAE saving for?

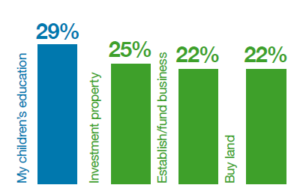

Funding their children’s education, investing in property and establishing or funding their own business are the most common aims for savers in the UAE.

Figure: UAE’s wealth creators’ top financial goals

Sonny Zulu, Head of Retail Banking at Standard Chartered UAE said:

“Identifying as high net worth or affluent now is not an indicator of being able to achieve your wealth aspiration in future. With 56 per cent of savers in our study looking set to be disappointed with their financial situation when it comes to retirement, the time to take action is now. Financial institutions have an important role to play, starting with an understanding of their clients’ needs, so that they can educate and empower them to manage their wealth in line with their aspirations”.

The Standard Chartered Wealth Expectancy Report 2019 is available to download at: www.sc.com/wealthexpectancy.